contact@kdccbank.com

Bank for a Better Tomorrow

Committed to helping our customers succeed.

-

01

Open an Account

Find out more about our range of everyday and savings accounts. Easy to apply only 2 minute.

-

02

Personal Account

We have accounts that provide a comfortable fit for any lifestyle. Find the right account today!

-

03

Business Accounts

Your business is unique and tailored to meet the needs of your customers,first priority is customers satisfaction.

Our Banking Services

Don’t just make a deposit, make an investment today.

Feature – Minimum Balance of Rs.6,000

Minimum Balance of Rs.1,000 and in multiples in future.

Minimum Investment Rs.15 Lac up to 1 crore

No Frill Rs. 0 Balance

Feature – Minimum Balance of Rs.4,000

Minimum Balance of Rs.1,000 and in multiples in future

Feature – Minimum Balance of Rs.4,000

Feature – Minimum Balance of Rs.1,000 and in multiples in future .

Choose your locker sizes

Easy to Operate

Nomination Facility

Best Locker

Facility For Your

Valuables

Safe Deposit Locker relieves you of all your safety concerns regarding your valuables. The benefits of Safe Deposit Locker include convenient locker rent payment options with many other facilities.

Our Objectives

The objectives of the bank, among others, are to finance cooperative societies, to carry on banking business, to arrange for supervision of affiliated cooperative societies to act as a balancing center for the surplus funds of the societies.

Our History

The Kolhapur District Central Cooperative Bank Ltd., Kolhapur was set up on October 1st, 1938 to meet the credit needs of some parts of the Kolhapur district, while the apex bank financed the remaining part. In 1952, the bank was allocated the service area of the apex bank. Since then, the bank has acted as a Central Cooperative Bank for the entire district in ST’s three-tier Cooperative credit structure. The bank was granted a license in November 1980 by the RBI under section 22 of the BR Act 1949 (AACS).

Members

The Bank functions at district level as federal body of the credit cooperative societies. There are 11630 society members of the Bank as on 31/3/2021.

Questions & Answers

Find answers to all your queries about our service.

-

How much can I borrow loan?

The limit of loan amount is Rs 40 Lakhs.

-

What is the rate of interest?

Please contact us through our contact us form now or simply visit your nearest branch.

-

Do you offering refinancing?

Please contact us through our contact us form now or simply visit your nearest branch.

-

When should I apply?

Please contact us through our contact us form now or simply visit your nearest branch.

-

How safe/secure is our net banking a/c?

Our online banking services is most secure. Whenever you’re using internet banking services, keep certain ...

Didn’t get, Click below button to more answers or contact us.

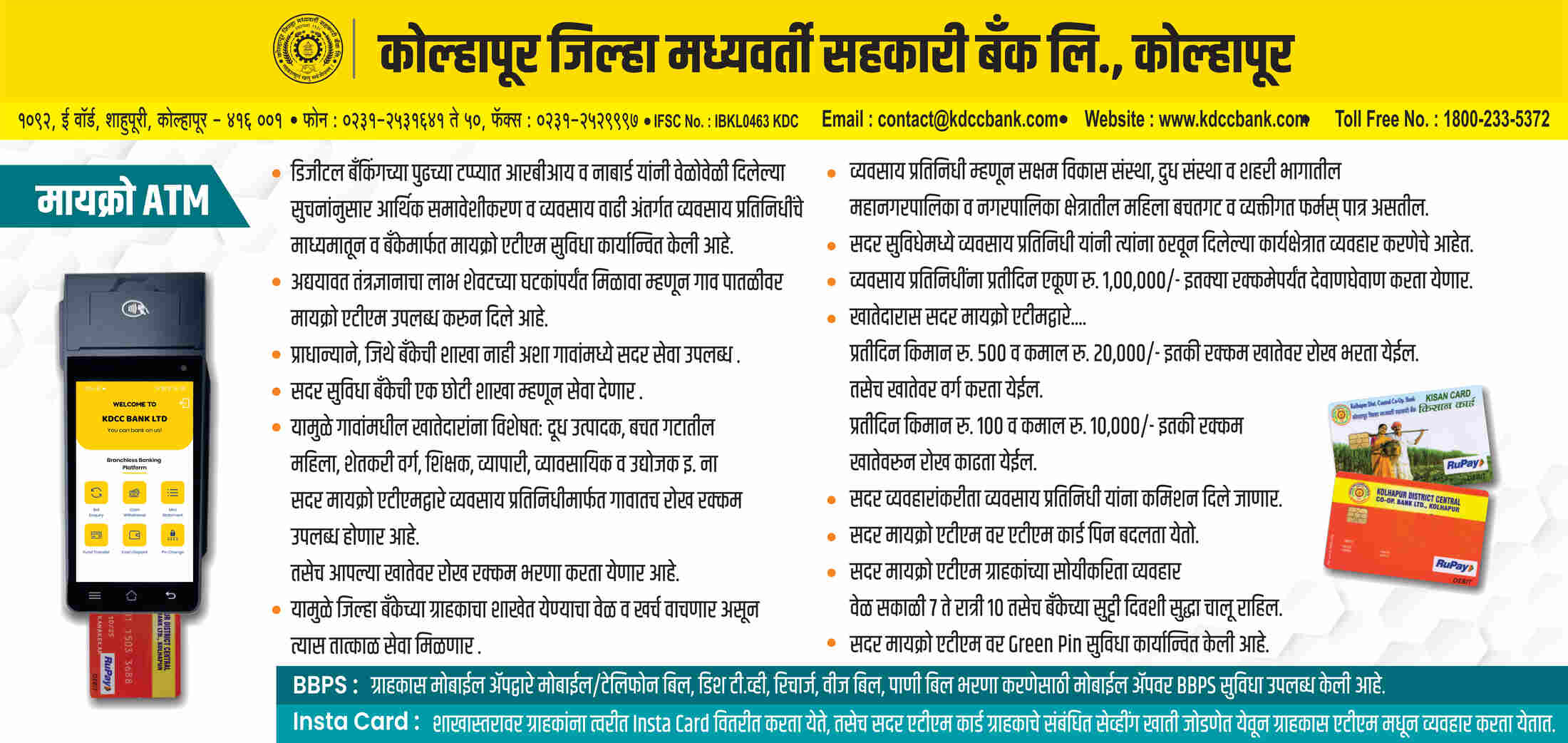

Micro ATM Service

The bank's Rupee Debit Card (ATM)

can be used to withdraw money from any bank's ATM in the country, as well as shopping malls, petrol pumps, hotels etc. through POS

-

Network

Banking services to customers in 300 villages -

NABARD sponsored

Micro ATMs

Start offering services to customers through mobile banking app

RTGS / NEFT anywhere in India

Gas subsidy through DBTL, government grants directly deposited in customers' bank accounts.

-

Spend

Minimum 40 US Dollar -

Not Valid for

Commercial Credit Card

Grab Benefits of Govt. Insurance

Insurance Service Available

Prime Minister's Life Jeevan Jyoti Insurance Scheme, Prime Minister's Security Insurance Scheme and Atal Pension Scheme available.

-

Prime Minister's Security Insurance Scheme

-

Atal Pension Scheme

Get Additional Benifits

Free facility to withdraw cash or transfer amount from any branch of the bank.

Grant amount distribution from all branches of the bank. Along with teacher's salary, pension, government's Sanjay Gandhi Niradhar, Shravanbal, Indira Gandhi Rashtriy Vruddhapakal etc.

-

All branches operate under core banking system.

-

SMS Alert feature available.

Front Title

This is front side content.

Back Title

This is back side content.